owner draw report quickbooks

Corporations should be using a liability account and not equity. You have an owner you want to pay in QuickBooks Desktop.

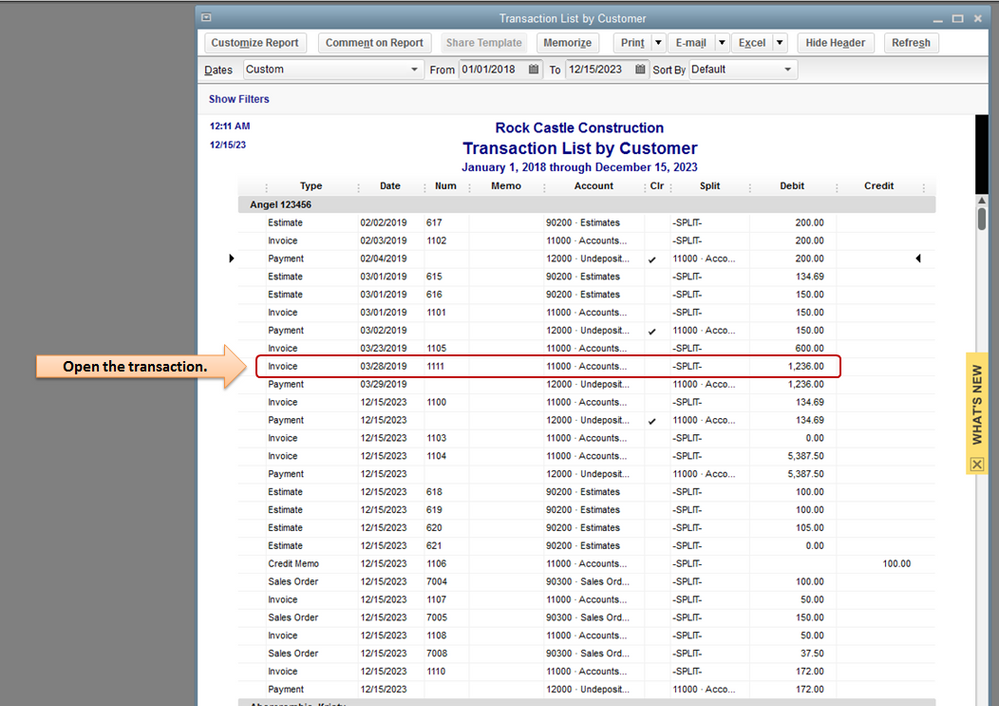

Solved How Do I Create A Custom Report For A Specific Account

It is also helpful to maintain current and prior year draw accounts for tax purposes.

. How do i run that report. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. The draw is a way for an owner to receive money from the.

Click Save Close. First you can view the accounts balances by viewing their register. Answer 1 of 5.

We also show how to record both contributions of capita. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Click Save Close.

At the bottom left choose Account New. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep. How do I show owners draw in Quickbooks.

Choose Lists Chart of Accounts or press CTRL A on your keyboard. At the end of the year or period subtract your Owners Draw Account balance from your Owners Equity Account total. For more details on how to record an owners draw in Quickbooks keep reading.

Click Save Close. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the balance of the owners equity.

Go to the Account details section. Click Equity Continue. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

To create an Equity account. The business owner takes funds out of the business for personal use. Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account.

Choose the Payee and the Bank Account used to withdraw the money. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. Select the Gear icon at the top then Chart of Accounts.

A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners. When you have an LLC all income flows through to the owners of the LLC on the K-1. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask.

The second way to view the balance is to run the Balance Sheet Report scroll down to the Equity section and youll see the sub-accounts from there along with their balances. Select New in the Chart of Accounts window. QuickBooks records the draw in an equity account that also shows the amount of the owners investment and the balance of the owners equity.

Enter an opening balance. Draws can happen at regular intervals or when needed. How do you record an owners draw in QuickBooks.

Set up and pay a draw for the owner. To record owners draws you need to go to your Owners Equity Account on your balance sheet. If you own a business you should pay yourself through the owners draw account.

The owner draws will simply decrease each individual capital account. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online. To create an owners draw account.

This means whether or not you take a draw you will be taxed on your share of the income the LLC receives. How do I report an owners draw in QuickBooks. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

At the top click the Create menu and select Cheque or Expense. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. An owner-draw is not reported on the K-1.

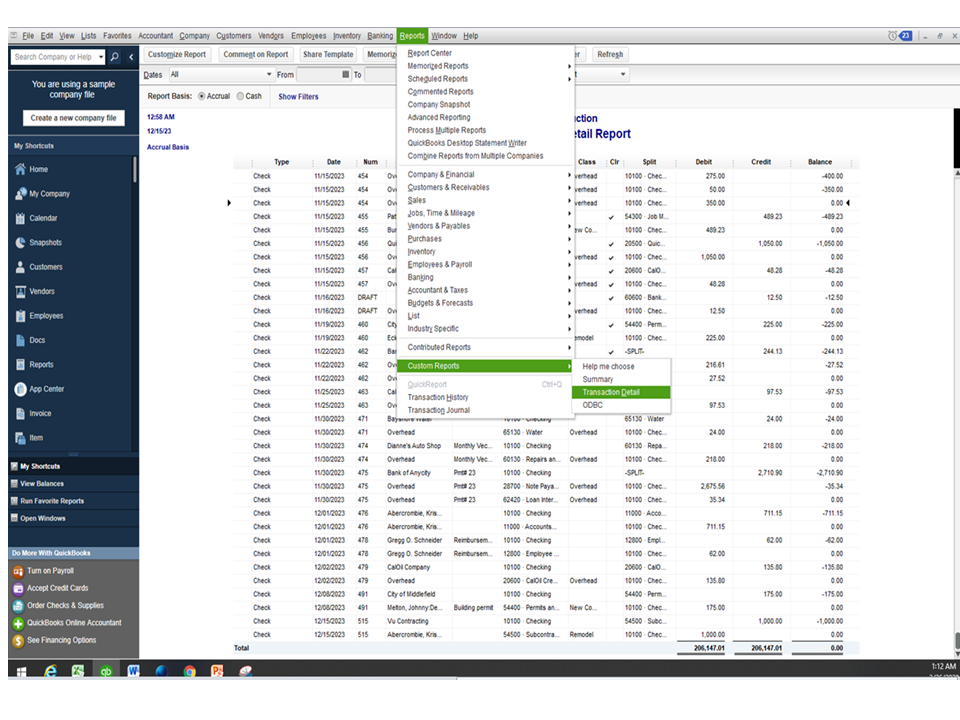

- Click on Reports Tab - Run the Profit Loss Report - At the top left of the Report click on the Customize Button - In the pop-up window set the Account Method to Cash Basis - Click Run Report - In QuickBooks. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership. How do I record an owners salary in QuickBooks.

Make sure you use owners contributionsdraws equity vs. In the ACCOUNT column enter Owners Equity or. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

Due tofrom owner long term liability correctly. Click Chart of Accounts and click Add Select the Equity account option. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks.

I just want a report on owners draw. The 1065 is simply an informational return. Click Equity Continue.

An owners draw is a separate equity account thats used to pay the owner of a business. Draws can happen at regular intervals or when needed. Set up draw accounts.

How do you record ownership of a distribution. To write a check from an owners. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name.

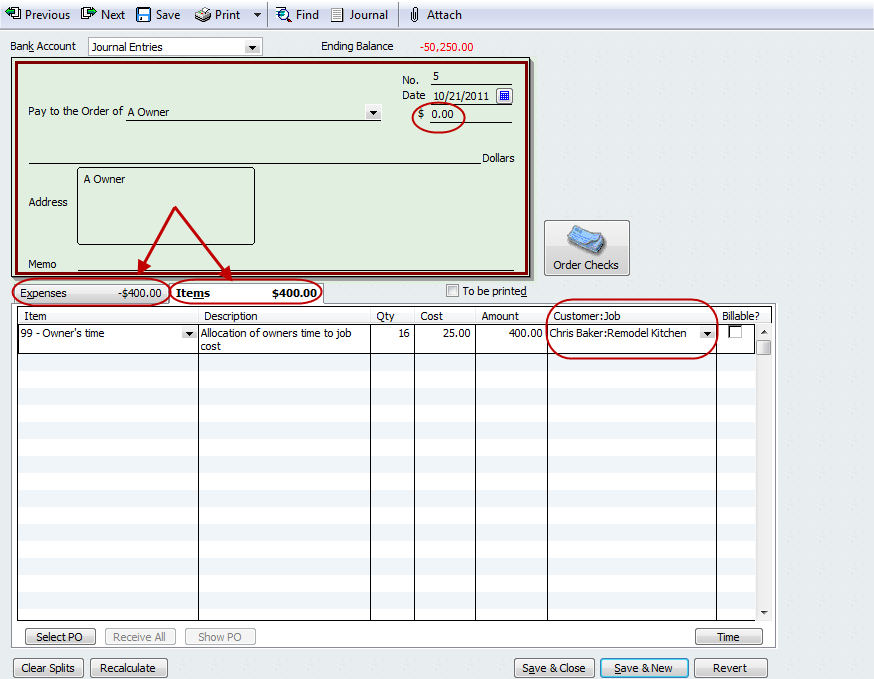

Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to the draw accounts. At the bottom left choose Account New. Do drawings count as expenses.

The funds are transferred from the business account to the owners personal bank account. Select Owners Equity from the Detail Type drop-down. Select Save and Close.

Select Equity from the Account Type drop-down. Enter Owner Draws as the account name and click OK. At the bottom left choose Account New.

QuickBooks Desktop doesnt have an actual transaction for closing entries it automatically creates. Choose Lists Chart of Accounts or press CTRL A on your keyboard. How do I show.

Select the Gear icon at the top and then select Chart of Accounts. How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window. Enter the account name Owners Draw is recommended and description.

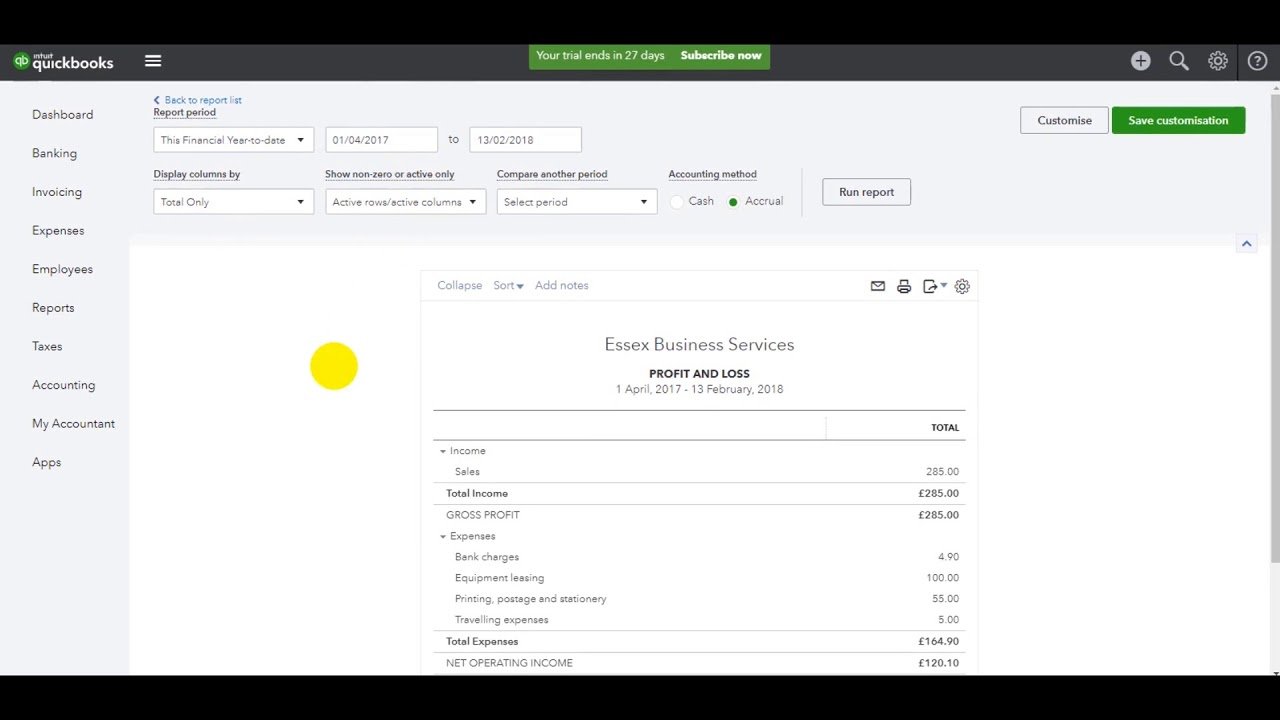

Click Equity Continue. Details To create an owners draw account. The process for customizing your Profit Loss Reports differs in QuickBooks Desktop QuickBooks Online - In QuickBooks Desktop.

Enter the account name Owners Draw is recommended and description. The program computes the adjustments when you run a report for example QuickReport of Retained Earnings but you cant QuickZoom on these transactions unlike the manual adjustments you recorded. Follow this procedure 1.

The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Enter the account name Owners Draw is recommended and description.

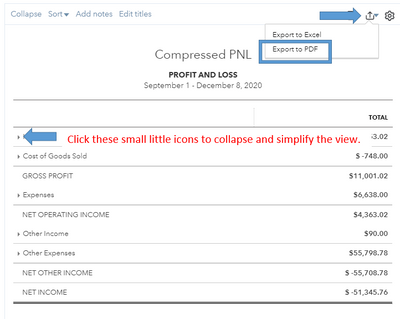

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

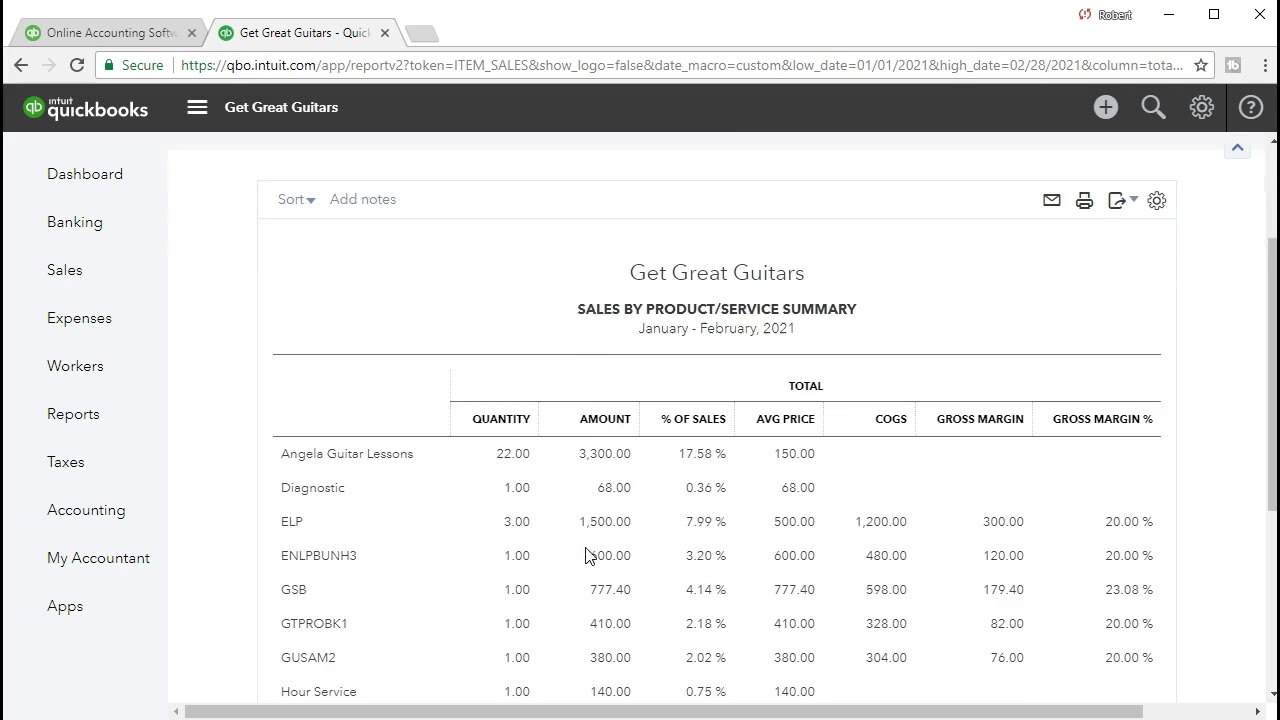

Quickbooks Online 4 25 Sales By Item Summary Report U Youtube

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Solved Custom Profit And Loss Report

Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

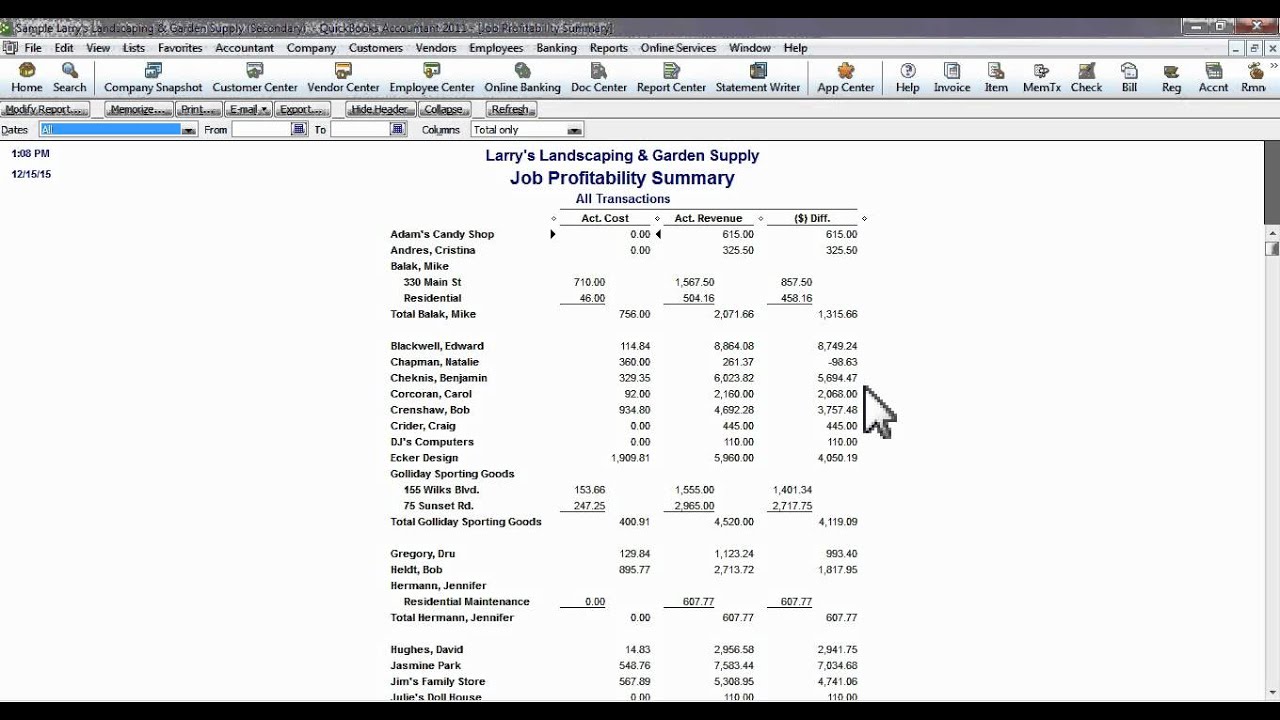

Quickbooks Job Costing Job Wip Summary Report Quickbooks Data Migrations Data Conversions

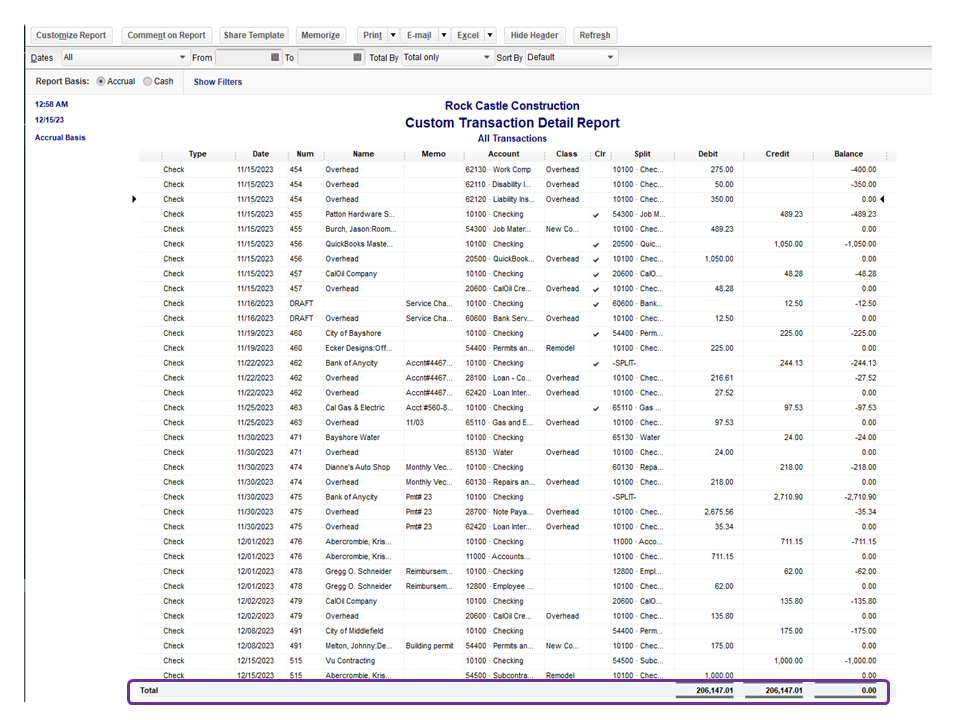

Solved Transaction Detail By Account Report

Save Custom Reports In Quickbooks Online Instructions Quickbooks Online Quickbooks Best Templates

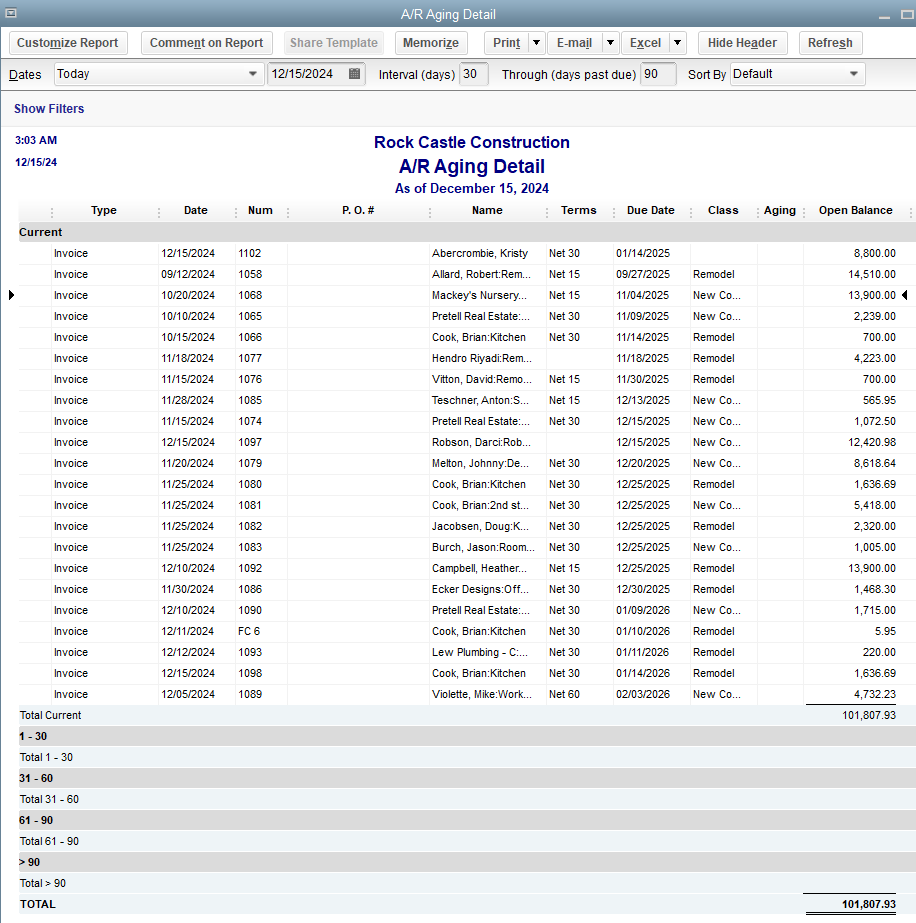

Accounts Receivable Aging Report

Creating Job Cost Reports In Quickbooks Youtube

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Intuit Quickbooks Desktop Pro Plus 2021 Accounting Software For Small Business 1 Year Subscription Quickbooks Data Backup Accounting Software

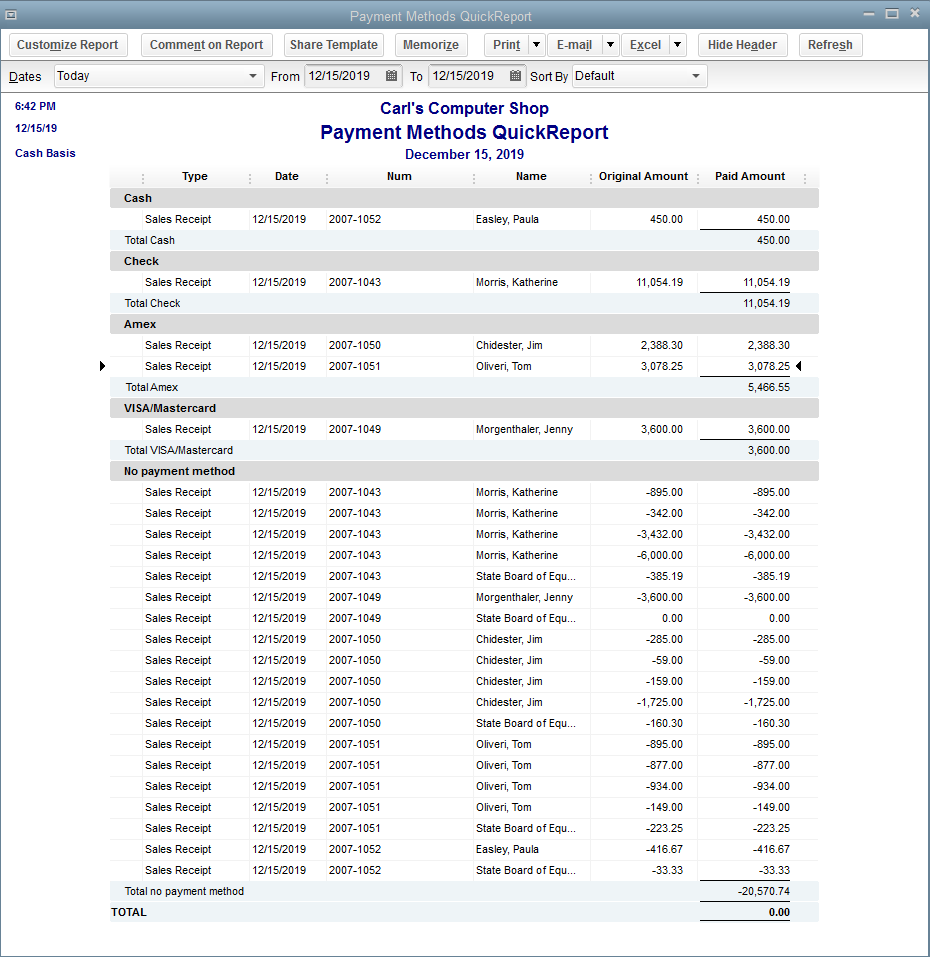

Daily Z Out Report For Quickbooks Desktop Sales Insightfulaccountant Com

Print A Report In Quickbooks Desktop Pro Instructions

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register